…

Integrated Bottom Line

…

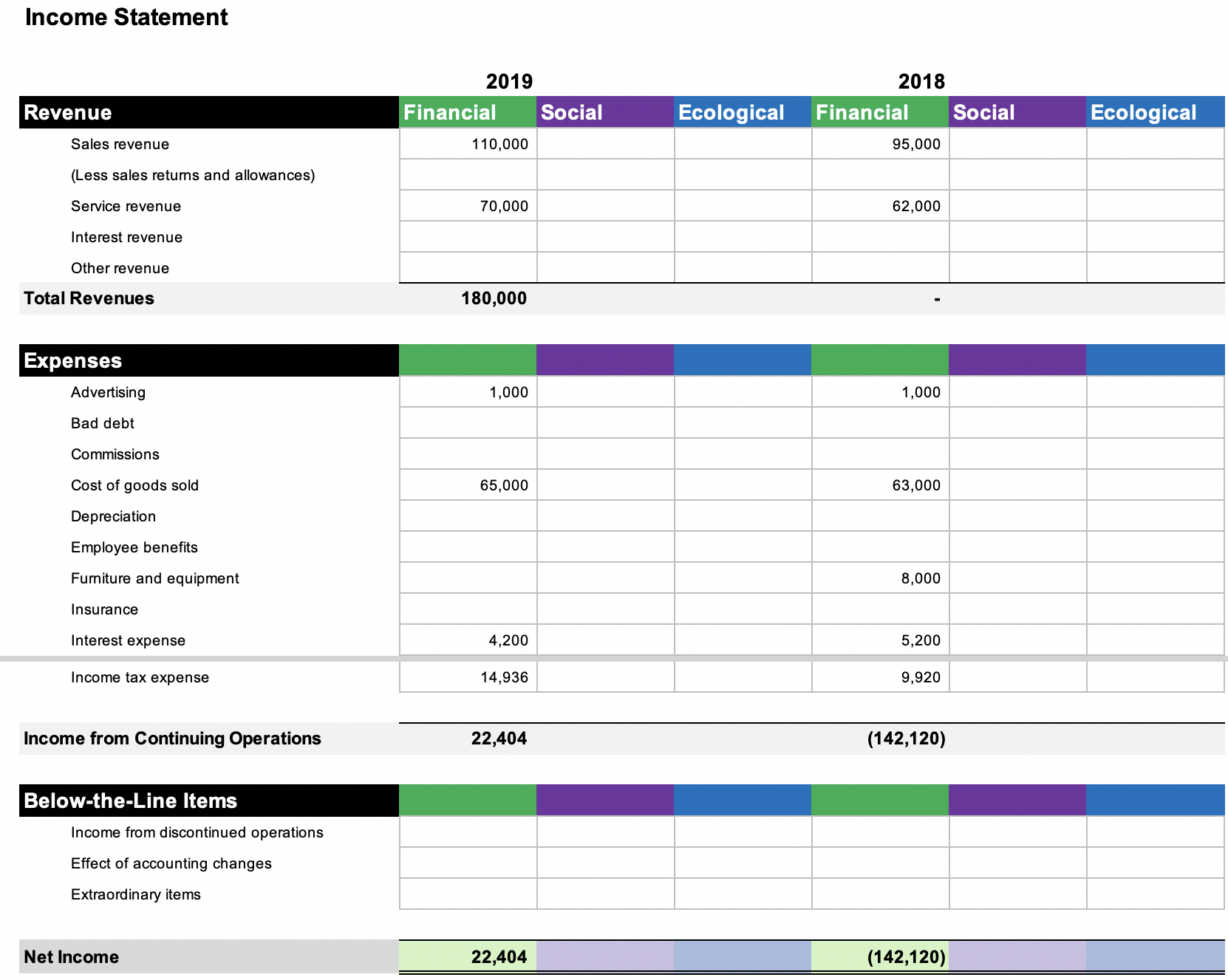

For over a decade, sustainability professionals and enthusiasts have talked about the “Triple Bottom Line” or, more holistically, the “Integrated Bottom Line.” The former term was coined by John Elkington in his book, Cannibals with Forks: The Triple Bottom Line of 21st Century Business. The idea is to be sure that organizational decisions of all kinds are made not just on the basis of money (the original “bottom line”) but also with and understanding of their ecological and social impacts. This is an ideal, of course, that tries to re-integrate impacts, issues, and concerns that are more than financial back into strategic, tactical, and operational decisions.

The sad truth is that there are NO tools to do this, in practice. Just try searching for them on the Internet. You won’t even find an image of what a tool like this might look like. Despite the years it has been discussed, if a leader declared tomorrow that their organization should start tracking each of these bottom lines and use them in decision-making, they would have no tools to do so. The needed tools include enhanced balance sheet, income statement, cash flow statement, and other accounting reports as well as planning documents for managerial (and not only financial) accounting. This doesn’t even include the recasting of nearly every financial management tool, such as an enhanced version of a department budget. Without these, it’s just not feasible to take into account social and ecological impacts alongside such finely presented financial ones.

Incidentally, the idea behind the “intergrated” bottom line, put forth by students at the Presidio Grdauate School, instead of the “triple” bottom line is the realization that, when times get rough, economically, it’s too easy to ignore the “other” two bottoms lines (social and ecological) because of the financial health of the organization. This is absolutely true and, yet, may sometimes be necessary to save the organization. Regardless, it’s imperative that decisions within an organization be made with the understanding of how they impact the organization and its various stakeholders in all three categories.

Economics experts have long talked about the need for “true cost” accounting in order to illuminate these other impacts. It’s one of the ways to deal with the “tradegy of the commons” and other economic phenomena that result when social and ecological impacts are ignored in favor of, only, financial ones. In an ideal world, these would be more apparent, perhaps in a simulation or dashboard, so that the impacts of these decisions, on all axis and for all stakeholders can immediately be seen before decisions are made. That’s the ideal, at least.

In my own time, I tried to lead a team to develop such tools, modifying well-known accounting tools (balance sheet, income statement, etc.) to be “threaded” or integrated so that impacts in one line item impacted others. Think of this as an evolved spreadsheet where a change in an expense, such as empoyee training, would show an impact elsewhere, such as costs of errors or risks of liability. Or, consider how expenses that might seem frivolous to some (like enhancements to employee experience and culture) offset other costs, like those to retain or hire replacement employees when current ones leave.

In the past, I’ve even tried to introduce linkages to an organization’s strategic goals into my budgets but this confused my superiors—it confounded them why this might be important or how to consider whether a particular line-item in my budget could or should support the organization’s strategies. Ultimately, however, this is the level of integration necessary if we’re going to convert ideas and goals into action.

This is the promise of intergrated bottom line accounting and it would absolutely be a boon to organizational decision-making, especially for those who find it difficult to remember or understand the myriad activities within the organization that contribute to its success and its risks. Ultimately, these apply more to managerial accounting and decision-making than financial accounting but the impacts would be felt throughout an organization and could be integrated into all aspects of management, including reward systems, reporting, success metrics, etc.

To date, I know of only one organization working to build these kinds of tools: SASB. This is a similar initiative to the international organization that governs and eolves financial accounting standards (FASB). They’ve been working toward developing these tools for nearly a decade but have yet to release usable tools. In some ways, this is probably the biggest imperative in sustainability and the future of business since it could impact decision-making throughout global organizations.

The Tool:

Sadly, this one is still theoretical. It would make a great project to work on for anyone interested.

Books:

• Cannibals with Forks

Organizations:

• The Sustainability Accounting Standards Board