…..

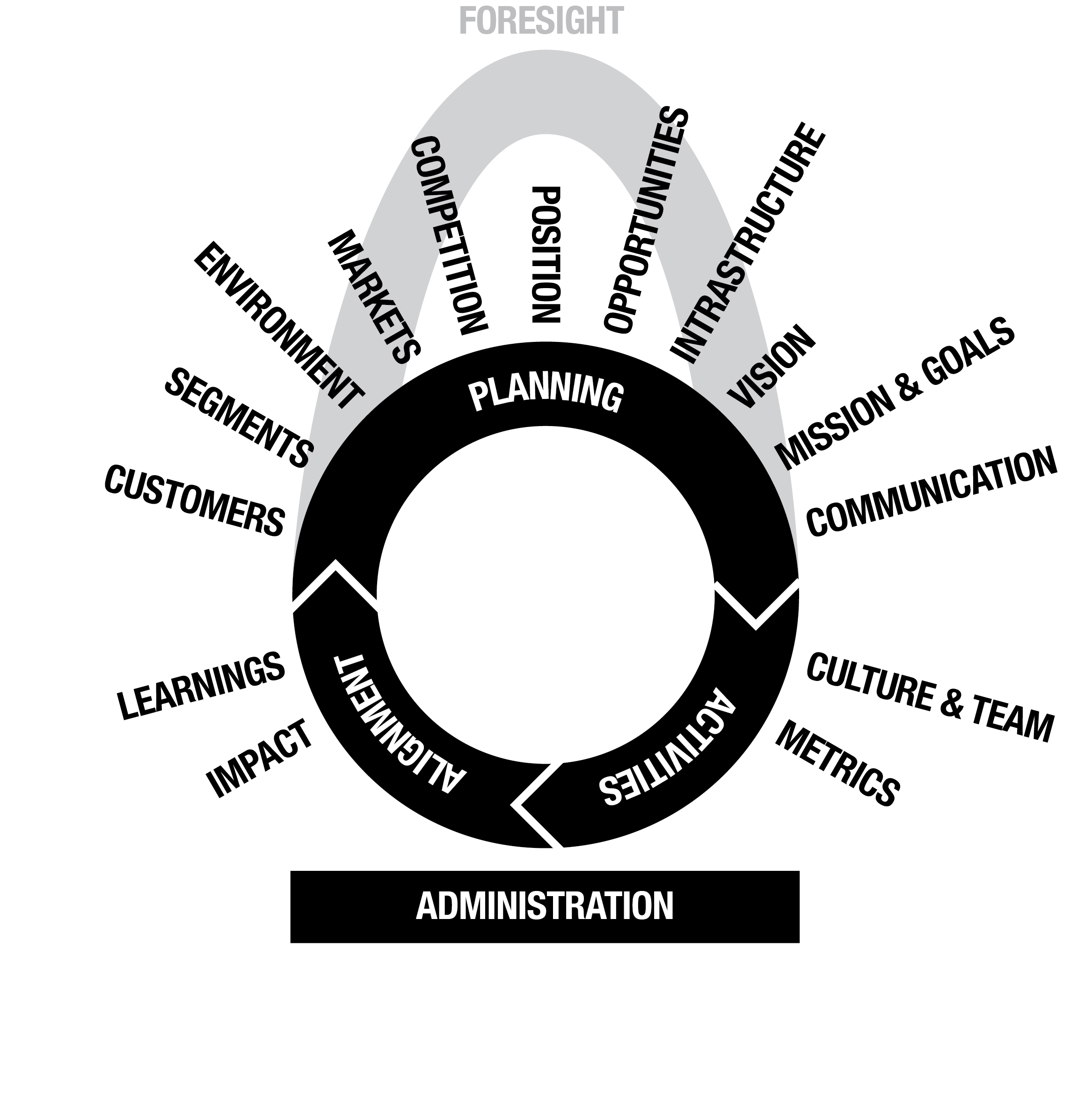

Continuous Strategy

…

Regis McKenna, one of the true masters of Marketing, taught me much about how to approach marketing and strategy. Back in the 1980s, the process Regis’ consulting firm devised was dubbed CRUSH (no acronym, just crush the competition”). It was created as a fast, hyper-focused market strategy process that could be implemented for a client quickly (I believe it was for Apple, in fact, and I think they had a deadline of only a couple weeks).

But, all of the parts of the CRUSH process are just as relevant today as they were so many decades ago. In fact, they are much more advanced than the typically sad state of “state-of-the-art” marketing taught in business schools and practiced in organizations worldwide. Some marketers now refer to the first part of this process as STEEP (standing for the Social, Technological, Economic, Environmental, and Political lenses applied during the process). Regardless of what it’s called, business professionals need to modernize their strategy and adopt the CRUSH process.

The reality of the vast majority of “marketing” practiced in the world is based on a few poorly-implemented processes (disconnected and out-of-order), colossal misunderstandings of people and markets, and more than a few lazily-used templates. I kid you not.

Continuous Strategy is a new way of framing strategy—not as something that is done every 3-5 years but something that is integrated with business operations so that the activities of the organization are always in step with its strategy (and vice versa). This requires us to avoid tradition and start from a new perspective:

- We need to recognize that typical “market research” over-emphasizes quantitative research, which may uncover the what and how of customers’ activities but that’s it. Qualitative research (sometimes called “market insight”) requires qualitative techniques to uncover the why of customer behavior. Without this, your market strategy is sunk, from the beginning.

- Qualitative research must precede quantitative research. Even a little will uncover the most important insights into customer decision-making and the decision drivers customers base their decisions upon. Once these are uncovered, quantitative research techniques can be used to explore how widespread and powerful these are, across industries, competitors, and markets. Then, qualitative research can be used again to uncover the details of customer behavior, cut as the triggers that signal to them the qualities they desire. Research simply goes back and forth between qualitative and quantitative from them on. You cannot skimp on this even if 1) you think it’s more difficult and more time-consuming or 2) you don’t understand or even believe in qualitative data.

- Environmental Analysis, Competitive Analysis, Positioning, and beyond (like Infrastructure, Market Segmentation, and Whole Product Development) are all connected, interrelated, and follow in this specific order. The key is that the outcomes of the preceding process are required as the inputs to the next process. This means that you cannotperform competitive research until you’ve identified the most important customer decision-drivers in Environment Analysis. Typically, in typical business strategy today, these processes are completely unrelated and done out-of-sequence (if they’re all done at all).

- While templates can be helpful, they’re mostly used as a crutch by strategists (and other business people pretending to be strategists). In fact, the typical Positioning Statement template is used willy-nilly in a process barely more sophisticated than mad-libs, and the results are completely unvalidated and represent the product of groupthink.

I’ve recently pulled all of this together into a new SaaS (Software as a Service) platform for doing better strategy more easily. ASTRA is still in beta, and just offers the basics, but I have plans to expand services and value greatly.

Companies and government, and NGOs, alike, spend vast sums of money on strategy—it’s one of the most lucrative consulting offerings in all of the consulting world. Yet, most of this work is inadequate and misleading because it’s not performed according to the simple principles above. In most companies, the people in customer service, the front lines of retail, and (if you’re lucky) the design researchers in product development, have a much better, deeper, and clearer understanding of customers than those in marketing. Yet, these professionals are rarely consulted or included in the strategy planning process. Strategy is too often reserved for an elite class in an organization, complete with offsites to exotic locations, privileged access to both outside experts and internal data, and representation from only the “cool” parts of the company. This creates a vacuum of reality when developing the very plan for the future of an organization.

The biggest deficiency throughout business is that lack of research, use, and integration of qualitative data. Too often, only quantitative data is seen as “real” data. Qualitative research techniques are invariably more time-consuming and expensive. But, the insights gained from them are also more valuable and insightful. So, this is no place to cut corners. These techniques include:

- In-depth Interviews (one-on-one, one-on-two, etc.)

- Ethnographic Techniques, including Observation, Embedding, Textual Analysis, etc.

- (Careful) Surveys (whereas most surveys are focused on the quantitative and terribly biased)

- Shadowing

- Laddering (this is one of the most effective mechanisms to gain insight into customer core meanings)

- Games

- Focus Groups (though I find these difficult to get valid insights from and don’t recommend them)

Many of these techniques are integral to what is now called “design research,” which focused on the qualitative side of customer experiences. One of the best overviews of Design Research techniques is in the book, Design Research, edited by Brenda Laurel and from MIT Press. The first chapter, written by a consummate long-time researcher, Christopher Ireland, breaks-down many techniques and describes why and when they can be effective.

One of the distinctions I help my students make when learning strategy is that strategy is where you determine what you should be doing (and want to do) as an organization and why that’s important. Tactics are the necessary how to accomplish these things. And, the best way to understand and decide the why is through qualitative data. Traditional, quantitative research techniques are notoriously bad at revealing the why of customer, market, competitor, and other decisions.

To be sure, the tools we need to streamline this process aren’t yet available and the few templates and processes we can turn to are so basic that we must apply them more as an art and not a science. However, that’s no reason to ignore them and not use them at all. It’s nearly criminal that these approaches have been around for decades without adequate development for wider use. In the mid-90s, I worked on a project to bring CRUSH to the business world via a software application but this never really “shipped.” The opportunity still exists, however.

A recent presentation and discussion of why Strategy is in Crisis and how Continuous Strategy can help can be found in a presentation to the Go Global community.

Tools:

ASTRA Strategy Platform

Stakeholder Analysis Map

Strategy Templates (Business Basics Workshop)

Presentation: Strategy is in Crisis

Slides: Strategy in Crisis

Workshop:

Business Basics

Related Books:

Design Research, edited by Brenda Laurel

Interviewing Users, by Steve Portigal